New construction starts in March advanced 16% from the previous month to

a seasonally adjusted annual rate of $809.2 billion, according to Dodge

Data & Analytics. The substantial gain followed a lackluster performance

during the first two months of 2019, as total construction starts in

March were able to climb back to a level slightly above the average

monthly pace during 2018. The nonbuilding construction sector, comprised

of public works and electric utilities/gas plants, jumped 40% in March

from a weak February, lifted by the start of a $4.3 billion liquefied

natural gas (LNG) export terminal in Cameron LA. Nonresidential building

increased 24% in March, aided by groundbreaking for several large

projects. These included the $1.6 billion Toyota-Mazda automotive

manufacturing facility in Huntsville AL, a $1.1 billion hotel and

theater redevelopment in New York NY, and the $850 million renovation of

the KeyArena in Seattle WA. In contrast, residential building slipped 3%

in March, as multifamily housing retreated for the second consecutive

month. During the first three months of 2019, total construction starts

on an unadjusted basis were $164.5 billion, down 10% from the same

period a year ago. On a twelve-month moving total basis, total

construction starts for the twelve months ending March 2019 essentially

matched the corresponding amount for the twelve months ending March 2018.

This press release features multimedia. View the full release here:

https://www.businesswire.com/news/home/20190418005472/en/

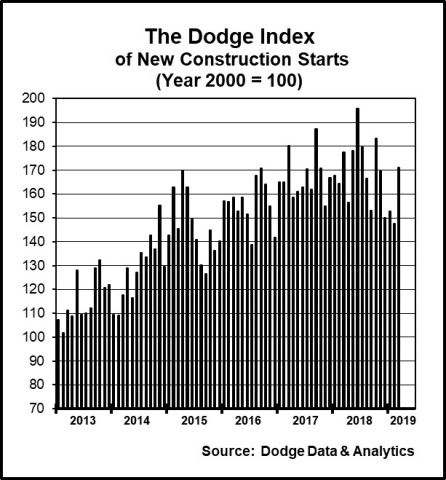

The March data produced a reading of 171 for the Dodge Index (2000=100),

up from 148 in February, and 1% higher than the full year 2018 average

for the Dodge Index at 170. At the same time, the Dodge Index during the

first quarter of 2019 dropped 6% from the fourth quarter of 2018, as it

was pulled down by the sluggish volume of construction starts during

January and February.

“The month-to-month pattern for construction starts is often affected by

the presence or absence of very large projects, and March certainly

benefitted from groundbreaking for a number of very large projects,”

stated Robert A. Murray, chief economist for Dodge Data & Analytics. “It

remains true that the construction expansion is decelerating, but the

March upturn indicates that the loss of momentum won’t be as pronounced

as suggested by the subdued activity in January and February. It’s still

expected that the overall dollar amount for construction starts for 2019

will be able to stay close to what was reported for 2018. On the plus

side, the passage of federal appropriations for fiscal year 2019 in

mid-February seems to be helping the public works sector. The electric

utility and gas plant category has shown surprising strength during

early 2019, following the steep declines over the previous three years.

The commercial building segment is supported by market fundamentals that

have yet to erode, while the institutional building segment continues to

move at a good clip. The areas of concern in the near term relate to

residential building, with single family housing not able to strengthen

due to affordability constraints while multifamily housing seems to be

pulling back from its strong 2018 pace.”

Nonbuilding construction in March increased 40% to $214.7 billion

(annual rate), following four straight months of decline that saw

activity drop a combined 19%. The electric utility and gas plant

category soared 116%, led by the inclusion of the $4.3 billion Calcasieu

Pass LNG export terminal project in Cameron LA as a March construction

start. Gas plant-related construction starts (primarily LNG export

terminals) had reached a peak back in 2015 at $26.2 billion, but then

plunged to only $0.6 billion by 2017 before rebounding to $5.1 billion

in 2018. The Calcasieu Pass LNG export terminal project should

contribute to another increase for gas plant-related construction starts

in 2019. If this massive project is excluded from the March statistics,

the electric power and gas plant category would have fallen 76% from

February, but gains would still have been shown by nonbuilding

construction, up 7%; and total construction, up 9%. The public works

categories as a group climbed 21% in March, rebounding after a 14% slide

in February. Miscellaneous public works (which includes such diverse

project types as site work, pipelines, and rail transit) jumped 84%

after a weak February, led by such projects as a $312 million segment of

the border wall in south Texas and a $283 million upgrade to a train

control signal system in Brooklyn NY. Highway and bridge construction

starts in March grew 4%, showing improvement after declines in January

(down 5%) and February (down 6%). The top five states for highway and

bridge construction starts in March, ranked by dollar volume, were –

Texas, California, Pennsylvania, Florida, and North Carolina. The

environmental public works categories showed a varied performance in

March, with gains for dams/river harbor development, up 62%; and water

supply construction, up 4%; but a decline for sewer construction, down

7%.

Nonresidential building in March advanced 24% to $303.3 billion

(annual rate), as widespread growth by project type enabled this sector

to reach its highest amount since last October. The manufacturing plant

category jumped 108%, lifted by the start of the $1.6 billion

Toyota-Mazda automotive manufacturing facility in Huntsville AL. The

next two largest manufacturing plants entered as March construction

starts were a $200 million rocket engine plant in Huntsville AL and a

$100 million poultry processing plant in Humboldt TN. The commercial

categories as a group increased 20% in March, registering the third gain

in a row after very weak activity back in December. Hotel construction

climbed 60%, led by the $850 million hotel portion of a $1.1 billion

hotel and theater redevelopment project located in Times Square New York

City. Additional large hotel projects that reached groundbreaking in

March were the $233 million hotel portion of the $950 million Grand

Avenue mixed-use high-rise complex in Los Angeles CA and a $187 million

beach resort hotel in Oceanside CA. Office construction increased 45% in

March, with seven projects valued at $100 million or more. These

included two large data centers – a $750 million Facebook data center in

Sandston VA and a $300 million CloudHQ data center in Ashburn VA. Also

reaching the construction start stage in March were two large office

projects in Atlanta GA – the $550 million Norfolk Southern headquarters

building and the $314 million office portion of a $470 million mixed-use

development. Store construction in March grew 11%, helped by the $150

million retail portion of the $1.1 billion hotel and theater

redevelopment in Times Square. Commercial garage construction in March

edged up 2%, but warehouse construction retreated 29% after its elevated

February amount.

The institutional side of nonresidential building grew 17% in March,

picking up the pace after basically flat activity during the previous

three months. Amusement-related construction starts jumped 90%,

reflecting the $850 million renovation of the KeyArena in Seattle WA

that will be home to an NHL team and potentially an NBA team. The $150

million theater portion of the $1.1 billion hotel and theater

redevelopment project in Times Square also lifted the amusement-related

category in March. Educational facilities, the largest institutional

category, grew 6% in March. Large projects that boosted the educational

facility category were a $500 million research laboratory for the U.S.

Department of Energy in Idaho Falls ID, a $173 million high school in

Worcester MA, and a $129 million science building at San Jose State

University in San Jose CA. Healthcare facilities edged up 2% in March,

helped by the start of a $310 million hospital at the University of

Pittsburgh Medical Center in Pittsburgh PA. The other institutional

project types showed mixed behavior in March – public buildings up 48%

after a weak February, religious buildings up 7%, and transportation

terminals down 22%.

Residential building in March dropped 3% to $291.2 billion

(annual rate), retreating for the second month in a row. Multifamily

housing fell 12% in March, with the level of activity coming in 20%

below the average monthly pace reported during 2018. There was one very

large project entered as a March construction start – the $511 million

multifamily portion of the $950 million Grand Avenue mixed-use high-rise

complex in Los Angeles CA. There were five additional multifamily

projects valued at $100 million or more that were entered as March

construction starts, including the $165 million One Boerum Place

condominium high-rise in Brooklyn NY and the $145 million multifamily

portion of a $300 million mixed-use high-rise complex in West Palm Beach

FL. The top five metropolitan areas ranked by the dollar amount of

multifamily starts in March were – New York NY, Los Angeles CA, Miami

FL, Washington DC, and Minneapolis-St. Paul MN. Single family housing in

March edged up 1% from the previous month, although its March level of

activity was still 7% below the average monthly pace reported during

2018. By geography, single family housing showed this pattern for March

relative to February – the Northeast, up 5%; the West, up 4%; the South

Central, up 3%; the South Atlantic, down 1%; and the Midwest, down 2%.

The 10% decline for total construction starts on an unadjusted basis

during this year’s January-March period was due to decreased activity

for all three main sectors compared to last year. Residential building

fell 15% year-to-date, with single family housing down 12% and

multifamily housing down 23%. Nonbuilding construction dropped 6%

year-to-date, as a 23% slide for public works was partially offset by a

161% hike for electric utilities/gas plants. Nonresidential building

retreated 5% year-to-date, with respective declines of 30% and 10% for

manufacturing plants and institutional building while commercial

building was able to register a 6% gain. By major region, total

construction starts for the first three months of 2019 showed this

performance versus last year – the Midwest, down 24%; the South Atlantic

and the West, each down 12%; the Northeast, down 6%; and the South

Central, up 2%.

Additional perspective comes from looking at twelve-month moving totals,

in this case the twelve months ending March 2019 versus the twelve

months ending March 2018. On this basis, total construction starts for

the most recent twelve months held steady with the amount of the

previous period. By major sector, nonresidential building increased 2%,

with manufacturing building up 9%, commercial building up 7%, and

institutional building down 3%. Residential building grew 1%, with

single family housing up 1% while multifamily housing was unchanged.

Nonbuilding construction dropped 4%, with public works down 5% and

electric utilities/gas plants down 1%.

| March 2019 Construction Starts | |||||||||

| Monthly Summary of Construction Starts | |||||||||

| Prepared by Dodge Data & Analytics | |||||||||

| Monthly Construction Starts | |||||||||

| Seasonally Adjusted Annual Rates, in Millions of Dollars | |||||||||

|

March 2019 |

February 2019 |

% Change |

|||||||

| Nonresidential Building | $303,263 | $245,551 | +24 | ||||||

| Residential Building | 291,234 | 298,758 | -3 | ||||||

| Nonbuilding Construction | 214,654 | 153,437 | +40 | ||||||

| Total Construction | $809,151 | $697,746 | +16 | ||||||

| The Dodge Index | |||||||||

| Year 2000=100, Seasonally Adjusted | |||||||||

|

March 2019…….171 |

|||||||||

|

February 2019…..148 |

|||||||||

| Year-to-Date Construction Starts | |||||||||

| Unadjusted Totals, in Millions of Dollars | |||||||||

|

3 Mos. 2019 |

3 Mos. 2018 |

% Change |

|||||||

| Nonresidential Building | $56,837 | $59,852 | -5 | ||||||

| Residential Building | 67,174 | 79,147 | -15 | ||||||

| Nonbuilding Construction | 40,508 | 43,292 | -6 | ||||||

| Total Construction | $164,519 | $182,291 | -10 | ||||||

About Dodge Data & Analytics: Dodge Data & Analytics is North

America’s leading provider of analytics and software-based workflow

integration solutions for the construction industry. Building product

manufacturers, architects, engineers, contractors, and service providers

leverage Dodge to identify and pursue unseen growth opportunities and

execute on those opportunities for enhanced business performance.

Whether it’s on a local, regional or national level, Dodge makes the

hidden obvious, empowering its clients to better understand their

markets, uncover key relationships, size growth opportunities, and

pursue those opportunities with success. The company’s construction

project information is the most comprehensive and verified in the

industry. Dodge is leveraging its 100-year-old legacy of continuous

innovation to help the industry meet the building challenges of the

future. To learn more, visit www.construction.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20190418005472/en/