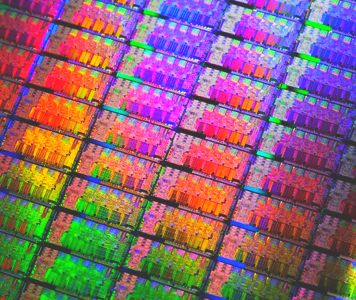

European Chip Makers Call For State Support

An industry study identifies AI and European semiconductor self-reliance as key priorities in uncertain times

European semiconductor companies are asking the European Commission to double the funding for a key chip research programme and continue another development scheme beyond 2020.

A report signed by 11 companies and research bodies in the European chip industry is asking for more EU support amidst a tentatitve recovery in the sector and the growing prospect of trade restrictions in China and the US.

The 20-page study was sent to Mariya Gabriel, the EU’s digital affairs commissioner, in response to her request for information earlier this year, Reuters reported.

The document is part of a broader debate around the seven-year EU funding term that begins in 2021, but has a particular urgency due to plans by China and the US to boost their own industries.

State investment

State investment

Europe’s $280 billion (£213bn) chip industry ranks far behind industry leaders Samsung Electronics and Intel, but is currently seeing a recovery after years of stagnation.

Germany’s Infineon said last month it would build a 1.6bn euro (£1.41bn) plant in Villach, Austria, its second for the manufacture of chips using 300mm wafers, in order to meet demand for chips used in industrial applications such as power management.

Infineon is a coordinator for a public-private research partnership called the Electronic Components and Systems for European Leadership Joint Undertaking (ECSEL), launched in 2014, for which the study called upon the European Commission to double state funding to 10bn euros.

The programme helps European companies, research institutes and smaller businesses to work across state borders, facilitating collaboration and innovation.

The report, titled “Rebooting Electronics Value Chains in Europe”, also recommends that a state-supported programme called Important Projects of Common European Interest (IPCEI) be continued into the next funding term.

Edge AI

IPCEI, led by governments and the EU, focuses on the development of new products.

The report also recommended boosting Europe’s self-reliance in semiconductors, creating a task force to focus on skills development, and unifying European research efforts.

It identifies the use of artificial intelligence to guide manufacturing processes or self-driving cars as a key priority, and particularly “edge AI” that doesn’t rely on a cloud-based server.

Edge intelligence and “Internet of Things” networked devices are a key area for European chip makers because they feed demand for the chips built into consumer products and vehicles, areas where European companies have strengths, as opposed to PCs, smartphones and servers, which are dominated by chip makers based elsewhere.

The report said AI was a “challenge” that was “too big” for public or private entities to address alone, but which could be addressed through collaboration.

Self-reliance

Self-reliance

The study also cited the increasing concentration of the global semiconductor industry through large-scale merges and acquisitions as a sign that Europe needed to increase its semiconductor self-reliance.

The report was signed by Soitec, STMicroelectronics, X-FAB Silicon Foundries, Robert Bosch, GlobalFoundries, United Monolithic Semiconductors, Infineon and ASML, with contributions from Fraunhofer Microelectronics Group, CEA-Leti and imec researchers.

It represents a “shopping list” from the semiconductor industry that is subject to EU budget negotiations, an unnamed industry source told Reuters.

The worldwide semiconductor industry is in a period of growth, with the global chip market up 20.2 percent year-on-year in April, its 21st consecutive month of year-on-year growth with a three-month average sales figure of $37.59bn, according to the Semiconductor Industry Association (SIA).

SIA chief executive John Neuffer said last week that the industry expects significant annual growth this year and more modest growth next year.