Roam, the platform for purchasing a home with an assumable low-rate mortgage included, today announced it secured a $1.25 million seed round and has officially launched its service. Roam helps buyers purchase a home with a mortgage as low as 2%, resulting in a monthly payment that is less than half of a traditional mortgage at today’s current rates.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230912357682/en/

(Graphic: Business Wire)

Keith Rabois at Founders Fund led the seed round with additional investment from Eric Wu (Opendoor co-founder), Ryan Johnson (Culdesac CEO), and #ANGELS Founding Partner Jana Messerschmidt. The company welcomes Tim Mayopoulos, former CEO of Fannie Mae, as a senior advisor. Eric Wu and Keith Rabois joined the board, bringing more than 40 years of real estate experience to the team.

With mortgage rates soaring past 7%, their highest level in decades, Roam offers a much-needed solution to the home affordability crisis. Roam helps homebuyers secure home loans as low as 2% through the mortgage assumption process. Assumable mortgages are a type of home loan that allows a homebuyer to take over, or assume, the existing mortgage terms from the seller. All government-backed loans (e.g., FHA and VA loans) are eligible for assumption by law, comprising about one-third of mortgages in the U.S.

“Assumable mortgages are one of the most undervalued assets in America,” said Raunaq Singh, Founder & CEO of Roam. “We started Roam as a way for homebuyers to take advantage of the assumable mortgage opportunity and increase access to affordable rates so that more Americans can realize their dream of homeownership.”

Roam helps sellers, buyers, and real estate agents in today’s challenging housing market. Sky-high rates have priced first-time homebuyers out of the market and drastically limited the pool of qualified buyers, making selling a home more difficult. Both inventory and home sales have declined to their lowest levels in over a decade. “This wave of immobility has created a once-in-a-lifetime opportunity for Roam to bring a much-needed solution to consumers and the housing market,” said Tim Mayopoulos, former CEO of Fannie Mae.

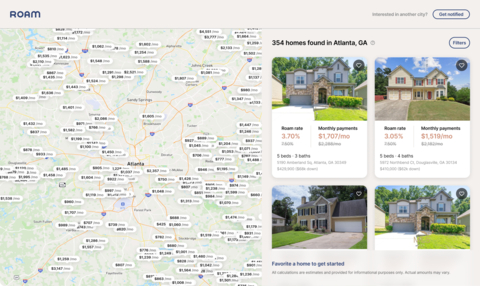

For homeowners with an assumable mortgage, Roam provides a differentiated marketing advantage with personalized marketing material to attract more potential buyers and better offers. Roam advertises their listing to qualified buyers through the Roam website, the only platform for buyers to easily search and discover homes with an assumable mortgage today.

For buyers, Roam provides the only destination to help them easily find available homes with low-rate assumable mortgages and manages all aspects of the assumption process on their behalf. On average, Roam buyers save up to 50% on monthly mortgage payments compared to buying a home with a traditional mortgage at today’s rates.

“Roam has an opportunity to touch 30% of all U.S. real estate transactions in the market and provide a solution to the most important problem buyers face today, affordability,” said Eric Wu, co-founder of Opendoor.

Roam provides these benefits for sellers, buyers, and agents:

- Discovery: Roam enables homebuyers to easily search for homes with mortgages eligible for assumption. Other digital real estate platforms lack this functionality.

- Simplicity: Roam manages the assumption process on behalf of sellers, buyers, and agents to help them have peace of mind that they will close on time. Roam manages all the operational details and provides customers with a hands-free experience.

- Transparency: Roam keeps buyers and sellers updated on the status of their mortgage assumption with an easily accessible dashboard and timely communications. Without Roam, the assumption process is opaque and time-consuming, often requiring buyers to fill out forms with pen and paper and fax documents to the lender.

“With mortgage rates north of 7%, Roam offers buyers the most affordable way to purchase their next home,” said Keith Rabois, Partner at Founders Fund. “Though the housing environment is marked by immobility today, Roam can 2x the volume of transactions by pulling forward moves from customers that may have otherwise been on the sidelines.”

Roam’s service is currently available in GA, AZ, CO, TX, and FL and will expand to new markets soon.

About Roam

Roam helps homebuyers wind back the clock and purchase their next home with a low-rate mortgage included. The company allows sellers to find more buyers in their home sale while enabling buyers to cut their monthly payments in half compared to buying the same house with a traditional mortgage. For more information on how we help buyers, sellers, and agents, please visit withroam.com.

About Founders Fund

Founders Fund invests in the world’s most important and valuable companies across all geographies, sectors and stages. The firm’s partners have been founders and early funders of companies including PayPal, SpaceX, Palantir, Airbnb, Stripe and Facebook. Founders Fund pursues a founder-friendly investment strategy, providing maximum support with minimum interference. More information is available at www.foundersfund.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230912357682/en/