Octopus Energy Group announced a new long-term strategic partnership with Canada Pension Plan Investment Board (CPP Investments), one of the world’s largest pension funds and a global force in energy investing.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20211214005893/en/

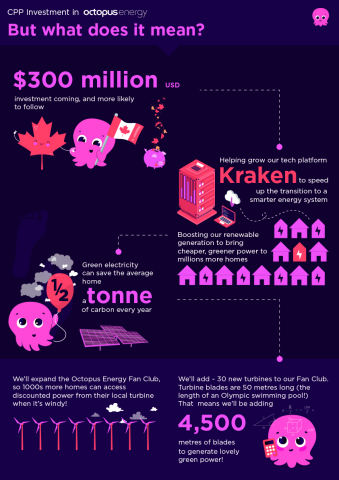

This global partnership is formed of an initial US$300 million equity investment from CPP Investments with an aspiration to grow the level of committed capital over time to support Octopus in their mission to drive the global green energy revolution. The deal follows a recent investment round with Generation Investment Management and increases Octopus Energy Group’s valuation to approximately US$5 billion.

The $300 million funding will support Octopus Energy’s’ global expansion, including in the U.S. This year, Octopus Energy opened its first U.S. headquarters in Houston, Texas, where it has grown its customer base by 10X. This $300 million will allow Octopus Energy to reach more consumers, deploy more renewable generation, advance new technologies, and collaborate with more energy companies, customers and utilities.

“This investment delivers a huge boost to our mission of expanding access to renewable energy and delivering exceptional customer service across all markets. Octopus Energy has turned energy on its head – thrown away the call centers, confusing bills and tired systems – to create a better customer experience for everyone that takes into consideration how consumers interact with their energy and smart home devices, while making the experience more enjoyable, visually appealing and understandable. We’re thrilled to continue making strides on this work, while advancing renewable energy and strengthening the grid across the U.S.,” said Michael Lee, CEO of Octopus Energy U.S.

The initial commitment from CPP Investments and the broader partnership will also help grow Octopus’s Kraken platform, accelerating the transition of energy assets globally. It will also boost Octopus’s smart grid capabilities and help expand the company’s green energy generation, including but not limited to the Fan Club – the U.K.’s first renewable energy tariff that gives communities close to specific wind turbines cheaper power when the blades are spinning significantly (80% of the time).

CPP Investments, the professional investment management organization managing the C$541 billion fund, is a significant provider of capital to companies looking to capture opportunities brought about by the energy revolution and the shift in global demand for low-carbon energy alternatives. Its Sustainable Energies Group, led by Bruce Hogg, is active across the global energy system with total assets of approximately C$19.5 billion, including investments in renewables, utilities, and power generation.

“In the decades to come, some of the most rewarding long-term investment opportunities in the global economy rest among those businesses that will enable, evolve and innovate along the path to a net-zero world. As a large, long-term investor, we are well-positioned to continue our leadership in investing in the whole economy evolution required by climate change. This investment and partnership with Octopus Energy, made through our Sustainable Energies Group, is a perfect example of how investors can work with leading tech-enabled energy companies to digitally disrupt the global energy system and support the evolution to a low carbon world,” said Deborah Orida, Chief Sustainability Officer and Senior Managing Director, Global Head of Real Assets, CPP Investments.

Octopus is driving a global green energy revolution, with a goal of 100 million energy accounts on Kraken, Octopus’s proprietary smart grid customer service technology, by 2027. Octopus’s renewable investment arm, Octopus Energy Generation, is one of Europe’s largest renewable energy investors and manages assets in excess of $4.5 billion. Current estimates put Octopus on the path to double its global generation portfolio, providing enough energy to power an additional 2 million homes by 2025.

“Octopus has pioneered the technology that allows citizens to benefit from cheaper energy as it gets greener. CPP Investments is a global force in energy investing, and their investment and partnership will enable us to build this truly innovative approach along the entire energy value chain. Innovating new ways to accelerate investment into the renewable energy revolution is vital to delivering governments’ net zero goals and the CPP Investments-Octopus partnership is globally significant, paving the way to billions of dollars of investment in the U.K. and globally. Make no mistake – this partnership is huge,” said Greg Jackson, CEO and founder of Octopus Energy Group.

Through the establishment of the Sustainable Energies Group (SEG), CPP Investments is building on existing strengths in renewables, conventional energy and innovation. Additionally, the organization’s Sustainable Investing (SI) group supports investment departments on the integration of relevant ESG considerations into investment decision-making and asset management.

This is another strong milestone for Octopus Energy following the investment by Generation Investment Management’s Long-term Equity strategy in September 2021.

About Octopus Energy Group

Octopus Energy Group is a global energy tech pioneer, launched in 2016 to use technology to unlock a customer focused and affordable green energy revolution. It is part of Octopus Group, which is a certified BCorp. With operations in 13 countries, Octopus Energy Group’s mission is going global.

Octopus’s domestic energy arm already serves 3.1 million customers with cheaper greener power, through Octopus Energy, M&S Energy, Affect Energy, Ebico, London Power and Co-op Energy. Octopus Electric Vehicles is helping make clean transport cheaper and easier, and Octopus Energy Services is bringing smart products to thousands of homes. Octopus Energy Generation is one of Europe’s largest investors in renewable energy, managing a $4.5 billion portfolio of renewable energy assets throughout the continent.

All of these are made possible by Octopus’s tech arm, Kraken Technologies, which offers a proprietary, in-house platform based on advanced data and machine learning capabilities, Kraken automates much of the energy supply chain to allow outstanding service and efficiency as the world transitions to a decentralised, decarbonised energy system. This technology has been licensed to support over 20 million customer accounts worldwide, through deals with EDF Energy, Good Energy, E.ON energy and Origin Energy.

In September 2021, Octopus Energy Group was valued at $4.6 billion after taking $600 million investment from Generation Investment Management, a firm that backs businesses that drive sustainability and the fight against climate change. It was the company’s third major investment round since launching to the market.

For more information, check out our website.

About Canada Pension Plan Investment Board

Canada Pension Plan Investment Board (CPP Investments) is a professional investment management organization that manages the fund in the best interest of the more than 20 million contributors and beneficiaries of the Canada Pension Plan. In order to build diversified portfolios of assets, investments are made around the world in public equities, private equities, real estate, infrastructure and fixed income. Headquartered in Toronto, with offices in Hong Kong, London, Luxembourg, Mumbai, New York City, San Francisco, São Paulo and Sydney, CPP Investments is governed and managed independently of the Canada Pension Plan and at arm’s length from governments. At September 30, 2021, the Fund totalled C$541.5 billion. For more information, please visit www.cppinvestments.com or follow us on LinkedIn, Facebook or Twitter.

View source version on businesswire.com: https://www.businesswire.com/news/home/20211214005893/en/