Mogo Inc. (NASDAQ:MOGO) (TSX:MOGO), a digital wealth and payments business, announced the launch of Moka.ai, the next generation of its wealth-building app with significant updates and enhancements designed to help the next generation of Canadians get on a real path to becoming millionaires and achieving financial freedom1.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240314354721/en/

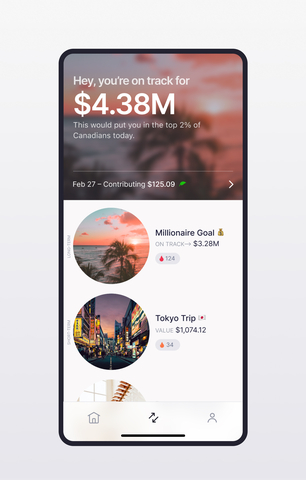

Power your wealth with behavioural science (Photo: Business Wire)

“A recent survey of Canadians aged 55 to 65 who have yet to retire revealed that 75% have less than $100,000 saved versus the average amount of $1.7 million that Canadians believe they need to retire2. This highlights how broken the system is and the opportunity for disruption,” said David Feller, Mogo’s Founder and CEO. “Our goal is to help ensure that the next generation doesn’t suffer the same fate. Leveraging decades of data and behavioral science, we have created a product that helps anyone get on a path to being a millionaire. With Moka, we are seeing people go from not having a financial path to retirement to being on track for retiring with millions. Some were investing in mutual funds, some were simply putting money in a savings account, but most had no idea what the right approach was or how much they would need to invest to achieve financial freedom. Moka makes it easy.”

The new Moka.ai app includes a powerful combination of features to help Canadians simplify and automate the wealth-building process.

- Power your wealth with behavioral science: Becoming a millionaire, like any important and challenging life goal, is more about adopting the right habits and behaviors than anything else. Losing weight, for example, is more about discipline and behavior than knowledge of what makes a good diet. Moka utilizes behavioral science to help you adopt the right habits to achieve financial excellence.

- Set and manage your goals with Moka’s financial freedom calculator: Moka now includes a patent-pending wealth calculator that helps anyone easily figure out how much they need to invest to achieve financial freedom. The calculator gamifies the right behaviors that help you achieve their financial goals.

- The most sustainable investing app in Canada: We know that it’s not all about the money, and achieving financial freedom while also having a positive impact is important to the next generation. Moka users are also helping replant Canadian forests devastated by wildfires. Our community has already planted over 300,000 trees.

- Proven Long Term strategy: Moka specializes in helping members invest in the S&P 500, historically averaging a 10% annual return since 19574. Over a 50-year time horizon, investing in the S&P 500 outperformed the average investor by more than 16 times. It has also outperformed more than 90% of money managers5 and has been recommended by legendary investors like Warren Buffett and Charlie Munger.

- Disruptive pricing model: One of the reasons Canadians dramatically underperform the market is because of the high fees charged in the industry. Moka introduces a revolutionary approach with a flat monthly fee of $7.00/month, regardless of the value of your investments. As a comparative example, $100,000 invested in a mutual fund at 2% would cost $2,000 in annual fees, vs $1,000 with a typical wealth advisor and only $84.00 with Moka. Over a typical 50-year investing horizon, this can mean hundreds of thousands in fees that can otherwise go towards your wealth.

- Simple automated investing: Moka is a fully managed solution. Users can easily automate their weekly or monthly investments and dividend reinvestments. The app also allows for fractional investing; Moka users can easily customize the amount they want to contribute.

- Artificial intelligence (AI): We believe AI will reshape the investing landscape, and the new Moka.ai app has been built with this future in mind. The roadmap for the app includes new applications of AI that are expected to enhance the user experience and help people better achieve their investment objectives.

Canadians can open a Moka.ai account today by downloading the app: App Store and Google Play.

1 – This projection is based on the Moka Equity Growth investment model, which is 100% invested in the S&P 500. It assumes a 10% rate of annual return, based on the S&P 500’s average return since its inception over the past 65 years, with dividends reinvested. Investing $20 per week for 50 years based on these assumptions would result in an investment of $1.25M. Investing $100 per week would put an investor on track for over $1M in 35 years through the power of compounding interest. Past performance is no guarantee of future results. The actual returns may vary.

2 – https://newsroom.bmo.com/2023-02-07-BMO-Annual-Retirement-Study-Canadians-Believe-They-Need-1-7M-to-Retire-Up-20-Per-Cent-from-2020

3 – https://hoopp.com/home/pension-advocacy/research/canadian-retirement-survey-2023

4 – The average annualized return since adopting 500 stocks into the index in 1957 through Dec. 31, 2023, is 10.26%. – https://www.investopedia.com/ask/answers/042415/what-average-annual-return-sp-500.asp

5 – https://www.aei.org/carpe-diem/more-evidence-that-its-really-hard-to-beat-the-market-over-time-95-of-finance-professionals-cant-do-it/

About Mogo

Mogo Inc. (NASDAQ:MOGO; TSX:MOGO) is a financial technology company headquartered in Vancouver, Canada. With more than 2 million members, $9.9B in annual payments volume and a ~13% equity stake in Canada’s leading Crypto Exchange WonderFi (TSX:WNDR), Mogo offers simple digital solutions to help its members dramatically improve their path to wealth-creation and financial freedom. Mogotrade offers commission-free stock trading that helps users thoughtfully invest based on a Warren Buffett approach to long-term investing – and make a positive impact with every investment. Moka offers Canadians a real alternative to mutual funds that overcharge and underperform with a passive investing solution based on a S&P 500 strategy at a fraction of the cost. Through its wholly owned digital payments subsidiary, Carta Worldwide, Mogo also offers a low-cost payments platform that powers next-generation card programs for companies across Europe and Canada. The Company, which was founded in 2003, has approximately 200 employees across its offices in Vancouver, Toronto, London & Casablanca.

Forward-Looking Statements

This news release may contain “forward-looking statements” within the meaning of applicable securities legislation, including statements regarding investment returns of the Moka.ai app and the use of AI in the app. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management at the time of preparation, are inherently subject to significant business, economic and competitive uncertainties and contingencies, and may prove to be incorrect. Forward-looking statements are typically identified by words such as “may”, “will”, “could”, “would”, “anticipate”, “believe”, “expect”, “intend”, “potential”, “estimate”, “budget”, “scheduled”, “plans”, “planned”, “forecasts”, “goals” and similar expressions. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual financial results, performance or achievements to be materially different from the estimated future results, performance or achievements expressed or implied by those forward-looking statements and the forward-looking statements are not guarantees of future performance. Mogo’s growth, its ability to expand into new products and markets and its expectations for its future financial performance are subject to a number of conditions, many of which are outside of Mogo’s control. For a description of the risks associated with Mogo’s business please refer to the “Risk Factors” section of Mogo’s current annual information form, which is available at www.sedarplus.com and www.sec.gov. Except as required by law, Mogo disclaims any obligation to update or revise any forward-looking statements, whether as a result of new information, events or otherwise.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240314354721/en/