Alternative Payments, a leading fully-integrated B2B payments and checkout infrastructure company, is excited to announce the launch of its groundbreaking product: Collections Assist. This new product aims to streamline and enhance the accounts receivable collections process for services companies across the United States.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20231218519800/en/

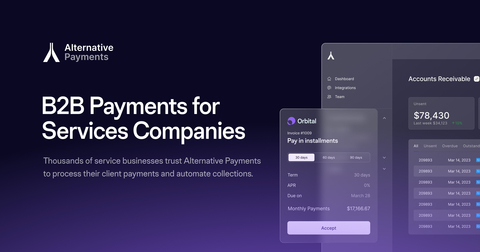

Alternative Payments Automated Accounts Receivable Management with Collections Assist (Graphic: Business Wire)

Alternative Payments is the first payments company to embed collections support within their product and help services companies get paid faster, even if their invoices are overdue and customers are refusing to pay.

Key Features of Collections Assist:

- Automated Activation: Invoices not paid within 30 days automatically activate within Collections Assist, allowing businesses to easily sort, evaluate and send overdue invoices to collections.

- Efficient Collections Management: Businesses can seamlessly send overdue invoices to collections in two clicks, automating manual processes and sending invoices to collections faster while saving operational headaches and time.

- Immediate Collection Support: Collections Assist facilitates faster collections, utilizing various collection techniques that may be too time-consuming for businesses to manage independently.

B2B Payments, Paired with Collections Assist:

Historically, the collections success rate for delinquent receivables is approximately 40%, meaning businesses may recover $0.40 cents for every delinquent dollar. Pairing Collections Assist with Alternative Payments’ receivables automation software aims to significantly improve these results. On average, Alternative Payments’ customers are paid in six (6) days after the invoice due date. By combining Alternative Payments offering with Collections Assist, companies will be able boost cash flow and improve net working capital considerably for both outstanding and overdue receivables.

About Alternative Payments:

Alternative Payments is a B2B payments and checkout infrastructure company. Alternative Payments’ end-to-end payment platform provides US services companies immediate access to merchant services, including credit card, ACH bank transfer and client-facing financing (B2B buy now pay later). Its software fully integrates within a company’s ERP and/or accounting software, providing instantaneous reconciliation.

For more information on Alternative Payments or Collections Assist, please visit alternativepayments.io.

View source version on businesswire.com: https://www.businesswire.com/news/home/20231218519800/en/