ARM ‘Saw Annual Revenue Decline’ Ahead Of IPO

UK-based chip designer ARM reportedly saw 1 percent annual revenue decline due to smartphone slump as it prepares bellwether IPO

Cambridge-based chip designer ARM saw its revenue decline about 1 percent in the most recent fiscal year ahead of a planned IPO that may take place as soon as September, according to multiple reports.

The company saw its sales fall to $2.68 billion (£2.1bn) in the year ended 31 March, according to unnamed sources and a draft IPO filing cited in the reports.

Sales for the quarter ended 30 June reportedly fell 2.5 percent to $675m.

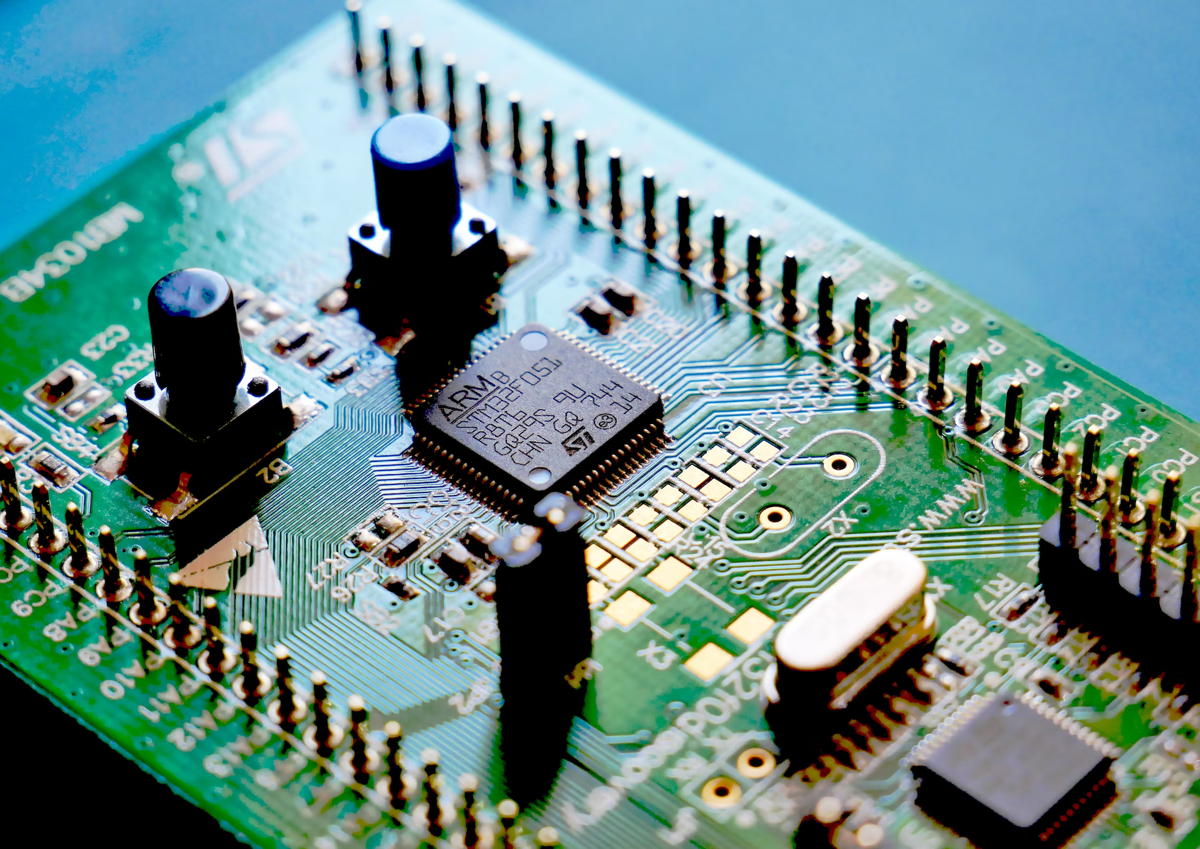

ARM’s designs are used in most smartphones and the company’s revenues were affected by a worldwide slump in phone shipments, reports said.

IPO plans

In May ARM parent SoftBank reported that ARM’s annual revenue had grown 5.7 percent under International Financial Reporting Standards.

ARM is expected to disclose its latest financial details as soon as later on Monday under US accounting standards.

SoftBank recently bought back a 25 percent stake in ARM that it had earlier sold to its Vision Fund unit in a deal that valued the chip designer at $64bn, according to earlier reports, placing additional pressure on SoftBank to meet a $60bn to $70bn valuation range for the offering.

The Japanese tech-focused holding company bought ARM for £23.4bn in 2016 and took it private for $32bn in 2016.

Economic uncertainty

It committed to the IPO after a proposed $40bn sale to Nvidia fell apart last year under widespread opposition from regulators.

SoftBank is reportedly working with lead banks Barclays, Goldman Sachs, JPMorgan Chase and Mizuho Financial on the IPO, along with 10 second-tier banks including Bank of America, Citigroup, Deutsche Bank and Jeffries Financial.

Demand for chips has fallen across smartphones, PCs and data centres this year, with artificial intelligence proving a rare bright spot – a factor that has recently pushed AI chipmaker Nvidia to a value of more than $1tn.