There is an estimated $1.56 trillion in student debt in the U.S.1 and December signifies the first time 2019 college graduates will begin paying back student loans, six months from graduation. But which industries are burdened most with student debt? According to new data from Fidelity Investments®,employees in the private health care and social assistance industries are far and away paying the most—$685 a month, which is more than $120 a month more than the nearest sector. The data is derived from nearly 30,000 users of Fidelity’s Student Debt Tool2.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20191029005195/en/

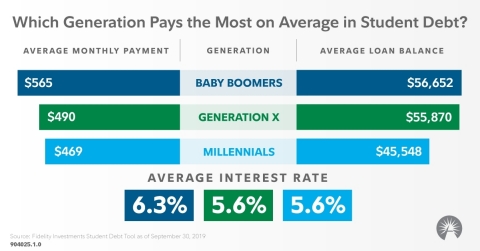

Which generation pays the most on average in student debt? (Graphic: Business Wire)

|

Industry3 |

Average Monthly Payment |

Average Loan Balance |

Average # of Loans |

|

Private health care and social assistance |

$685 |

$75,336 |

3.9 |

|

Higher education |

$563 |

$60,758 |

4.6 |

|

Professional Scientific and Technical services |

$543 |

$55,167 |

4.5 |

|

Non-profit health care |

$515 |

$56,996 |

4.3 |

|

Information Services |

$487 |

$47,812 |

4.2 |

|

Manufacturing |

$465 |

$44,062 |

4.3 |

|

Business Management |

$446 |

$45,917 |

4.1 |

|

Real Estate |

$434 |

$42,418 |

4.0 |

|

Transportation |

$413 |

$43,964 |

3.8 |

|

Retail trade |

$406 |

$42,266 |

4.5 |

“The data is clear — finding ways to effectively pay down student debt isn’t an isolated problem. It is impacting young and old, as well as workers in various industries,” said Asha Srikantiah, head of Fidelity Investments’ student debt program.

“Our research consistently shows that student debt can have a devastating impact on the financial wellness of many Americans, causing them to delay life events such as buying a home, getting married, having children, and saving for retirement. Part of the solution is knowing where you stand, which is why Fidelity offers resources to help employees and employers work together to craft a path to action,” continued Srikantiah.

The Student Debt Tool, which is part of Fidelity’s broader Student Debt Benefits program launched in 2018, enables borrowers to have a singular view of a variety of federal and private loan options by aggregating all of their student debt loans in one place. Perhaps surprisingly, the data reveal that student loan debt is not a problem isolated only to the young. In fact, although the majority of Student Debt Tool users who reported their debt are Millennials, users who are Baby Boomers or Generation X actually carry a higher average student debt loan burden.

|

Generation |

# of Users |

Average Monthly Payment |

Average Loan Balance |

Average Interest Rate |

|

Baby Boomers |

1,599 |

$565 |

$56,652 |

6.3% |

|

Generation X |

6,996 |

$490 |

$55,870 |

5.6% |

|

Millennials |

21,034 |

$469 |

$45,548 |

5.6% |

The data also demonstrates that many individuals are delaying contributing to their retirement or, just as distressing, taking out loans against their 401(k), an action that is literally borrowing against one’s future to pay for the past. Almost one in five (19%) of Student Debt Tool users report contributing nothing to their 401(k), with one in four (24%) only contributing between one to five percent of their salary. Overall, 13.9% report having an outstanding loan against their 401(k), which is a concern because these loans can have a dramatic negative impact on 401(k) balances—particularly with younger retirement savers, who have a longer time horizon and as a result, greater potential in their early years to save more.

Fidelity’s Student Debt Program Offers an End-to-End Solution

Finding effective ways to pay down student debt isn’t a one and done solution, but a challenge that can be quite different depending on what stage of life someone is in — whether it’s a question of paying off debt, understanding how much debt has been accumulated or saving for a child’s education. The Student Debt Tool is designed to address the issue of knowing where one stands, by helping see all accumulated student loans in one place and the options available for repayment. Fidelity’s Student Debt Program provides additional solutions and education, including:

- A Student Debt Benefits program, enabling employer-sponsored student debt benefits in a variety of benefit designs, including Student Debt: DirectSM, which makes student debt payments directly to a loan service provider; Student Debt: Benefit ChoiceSM, which leverages the power of other benefits to help reduce student debt; and Student Debt: RetirementSM, where employers trigger 401(k) contributions off employee student loan payments. Fidelity was one of the first companies to offer such a program, building upon its 70-plus year history of using innovation to help Americans address a variety of financial needs, and its clients represent a wide array of employer sizes and geographies, including Raytheon, Travelers, Unum, Kronos and Hewlett Packard Enterprise.

- Pre-College Planning Resources to address the issue of taking on too much debt, by offering targeted education and resources to help families plan, save and pay for college.

Fidelity also offers access to a student debt refinancing platform, Credible.com4, through its Student Debt Tool. This gives users the ability to compare pre-qualified rates from up to ten refinancing lenders without affecting their credit score. Credible helps users refinance their loan with the lender of their choice—and in the near future, Student Debt Tool users will get a $750 bonus from Credible once they close on a refinancing loan5.

“By adopting a holistic approach, we are helping employers get in the trenches with employees to find ways to pay student debt off faster and hopefully, save money,” said Srikantiah. “What we have learned this past year is growing numbers of companies are increasingly aware that helping employees address the issue of student debt can help improve their overall financial wellness, which can in turn have a positive impact from a business perspective in a host of ways.”

About Fidelity Investments

Fidelity’s mission is to inspire better futures and deliver better outcomes for the customers and businesses we serve. With assets under administration of $7.8 trillion, including managed assets of $2.8 trillion as of September 30, 2019, we focus on meeting the unique needs of a diverse set of customers: helping more than 30 million people invest their own life savings, 22,000 businesses manage employee benefit programs, as well as providing more than 13,500 financial advisory firms with investment and technology solutions to invest their own clients’ money. Privately held for more than 70 years, Fidelity employs more than 40,000 associates who are focused on the long-term success of our customers. For more information about Fidelity Investments, visit www.fidelity.com/about.

Fidelity Investments and Fidelity are registered service marks of FMR LLC.

Fidelity Brokerage Services LLC, Member NYSE, SIPC

900 Salem Street, Smithfield, RI 02917

Fidelity Investments Institutional Services Company, Inc., SIPC

500 Salem Street, Smithfield, RI 02917

National Financial Services LLC, Member NYSE, SIPC

200 Seaport Boulevard, Boston, MA 02110

904209.1.0

© 2019 FMR LLC. All rights reserved.

1 Source: As of 4Q 2018, Federal Reserve & New York Federal Reserve

2 Data derived from nearly 30,000 Student Debt tool users who shared loan information representing more than 4,400 companies, as of September 30, 2019.

3 Industries represented had at least 500 unique participants reporting data.

4 Credible is not affiliated with Fidelity Brokerage Services, member NYSE, SIPC or its affiliates. Credible is solely responsible for the information and services it provides. Fidelity disclaims any liability arising from your use of this information.

5 To receive the bonus, Fidelity customers or participants in Workplace-sponsored plans must access Credible through a Fidelity approved channel (Fidelity.com or NetBenefits) and close on a student loan refinance through one of Credible’s lender partners. Residents in these states are not eligible for the bonus: California, Connecticut, Louisiana, Maine, Massachusetts, Nevada, New Hampshire, New Jersey, New Mexico, North Dakota, Ohio, Pennsylvania, Rhode Island, Tennessee, Vermont, Washington, DC, Wisconsin, and West Virginia.

View source version on businesswire.com: https://www.businesswire.com/news/home/20191029005195/en/