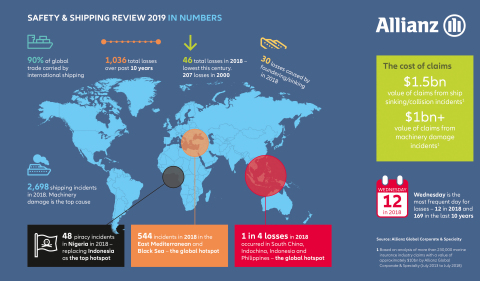

Large shipping losses are now at their lowest level this century having

declined by over 50% year-on-year, according to Allianz

Global Corporate & Specialty SE’s (AGCS) Safety

& Shipping Review 2019. The annual study analyzes reported

shipping losses over 100 gross tons (GT).

This press release features multimedia. View the full release here:

https://www.businesswire.com/news/home/20190604005056/en/

2018 saw nearly 2,700 shipping incidents, but total losses are at their lowest this century: Allianz (Graphic: Business Wire)

In 2018, 46

total losses of vessels were reported around the shipping world,

down from 98 losses 12 months earlier, driven by a significant decline

in activity in the global loss hotspot, South East Asia, and

weather-related losses (10) halving after quieter hurricane and typhoon

seasons.

While this plummet in total losses is encouraging, the number of

reported shipping incidents overall (2,698 in 2018) shows little decline

– less than 1% year-on-year. Machinery damage is the major cause,

accounting for more than a third of the 26,000+ incidents over the past

decade – twice as many as the next highest cause, collision. Machinery

damage is one of the most expensive causes of marine insurance claims,

accounting for US $1bn+ in five years1.

“Today’s record low total loss activity is certainly influenced by

fortunate circumstances in 2018, but it also underlines the culmination

of the long-term improvement of safety in the global shipping industry,”

says Baptiste Ossena, Global Product Leader Hull & Marine

Liabilities, AGCS. “Improved ship design, technology, tighter

regulation and more robust safety management systems on vessels have

also helped to prevent breakdowns and accidents from turning into major

losses. However, the lack of an overall fall in shipping incidents,

heightened political risks to vessel security, complying with 2020

emissions rules and the growing number of fires on board bring

challenges.”

Worst accident locations and common causes of loss

The South China, Indochina, Indonesia and Philippines maritime region

remains the top loss location. One in four occurred here in 2018 (12),

although this is significantly down from 29 a year earlier. The East

Mediterranean and Black Sea (6) and the British Isles (4) rank second

and third. Despite signs of improvement, Asia will remain a hotspot for

marine claims due to its high level of trade, busy shipping routes and

older fleets. However, newer infrastructure, better port operations and

more up-to-date navigation tools will help to address challenges.

Cargo

ships (15) accounted for a third of vessels lost around the world in

the past year. The most common cause of ship losses remains foundering

(sinking), which has accounted for more than half (551) of the 1,036

lost over the past decade. In 2018, 30 cases were reported.

Fires

continue to generate large losses on board with the number of reported

incidents (174) trending upwards. This has continued through 2019 with a

number of recent problems on container ships and three significant

events on car carriers. Misdeclared cargo, including incorrect

labelling/packaging of dangerous goods is believed to be behind a number

of fires at sea. Meanwhile, the loss of hundreds of containers over

board from a large vessel in early 2019 provides a reminder that damaged

goods is the most frequent generator of marine insurance claims,

accounting for one in five over five years1.

Emissions compliance brings challenges

Regulation limiting sulphur oxide emissions from January 2020 is likely

to be a game-

changer for the shipping industry, with wide-ranging implications

for cost, compliance and crew. Large ports globally are even considering

deploying so called “sniffer drones” to detect environmental

rule-breakers – ships not using more expensive low-sulphur fuels may

face significant penalties.

Security threats evolve and challenge

Political

risk has heightened around the globe and increasingly poses a threat

to shipping security, trade and supply chains through conflicts,

territorial disputes, cyber-attacks, sanctions, piracy and even

sabotage, as evidenced by recent attacks on oil tankers in the Middle

East. The growing number of migrants at sea and an increase in stowaways

on commercial vessels also has serious consequences for ship owners,

leading to delays, diversions and pressure on crew. Piracy incidents

increased in 2018 to more than 200 – Nigeria is now the top global

hotspot.

Other risk topics in the AGCS Safety and Shipping Review include:

-

The growing number of incidents on larger vessels is concerning.

Container-carrying capacity has almost doubled over a decade and a

worst case loss scenario could cost as much as US $4bn in the future. -

Trusting technology: Safety-enhancing technology in shipping

has been a positive for safety and claims, yet accidents continue to

happen due to overreliance – even down to losses occurring from crew

being on phones. -

Autonomous shipping makes waves: Progress continues to be made

but technology is not a panacea if the root cause of incidents and

losses is not addressed. -

All at sea – The most accident-prone vessels of the last year

are three Greek Island ferries, all of which were involved in eight

different incidents.

AGCS provides global marine and shipping insurance for all types of

marine risk, from single vessels and shipments to the most complex

fleets and multinational logistics businesses. The Marine

Line of Business contributed 11% to AGCS overall premium volume of

EUR 8.2bn in 2018.

About Allianz Global Corporate & Specialty

Allianz Global Corporate & Specialty (AGCS) is a leading global

corporate insurance carrier and a key business unit of Allianz Group. We

provide risk consultancy, Property-Casualty insurance solutions and

alternative risk transfer for a wide spectrum of commercial, corporate

and specialty risks across 12 dedicated lines of business.

Our customers are as diverse as business can be, ranging from Fortune

Global 500 companies to small businesses, and private individuals. Among

them are not only the world’s largest consumer brands, tech companies

and the global aviation and shipping industry, but also wineries,

satellite operators or Hollywood film productions. They all look to AGCS

for smart answers to their largest and most complex risks in a dynamic,

multinational business environment and trust us to deliver an

outstanding claims experience.

Worldwide, AGCS operates with its own teams in 34 countries and through

the Allianz Group network and partners in over 200 countries and

territories, employing over 4,400 people. As one of the largest

Property-Casualty units of Allianz Group, we are backed by strong and

stable financial ratings. In 2018, AGCS generated a total of €8.2

billion gross premium globally.

For more information please visit http://www.agcs.allianz.com/

or follow us on Twitter @AGCS_Insurance and LinkedIn.

Cautionary

Note Regarding Forward-Looking Statements

____________________

1 Based on analysis of 230,961

marine insurance industry claims featuring AGCS and other insurers

between July 2013 and July 2018

View source version on businesswire.com: https://www.businesswire.com/news/home/20190604005056/en/