CoreLogic® (NYSE: CLGX), a leading global property information, analytics and data-enabled solutions provider, today released its 2019 Rental Applicant Risk (RAR) Report, showing the national RAR index declined by two points, compared to 2017, to 83. This indicates a decline in tenant risk, which could suggest the rental market will see an uptick in profitable lease activity. The annual report provides a benchmark of national and regional applicant traffic credit quality scores and indicates the relative risk of an applicant pool fulfilling lease obligations. The 2019 report found the credit quality of prospective property renters in the U.S. improved over the past five years across the Northeast, West, South and Midwest regions.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20190731005710/en/

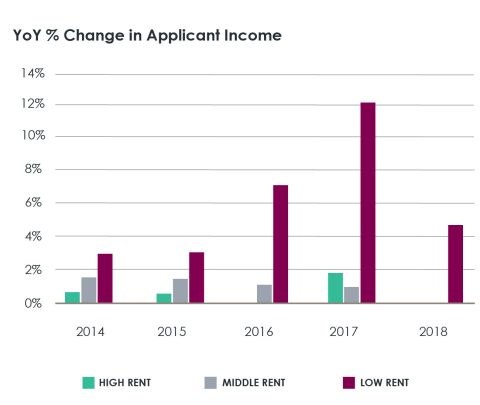

National Year-Over-Year Percentage Change in Applicant Income, 2014-2018; CoreLogic 2019

Data from the RAR Report shows favorable conditions for the continued improvement in rental applicant qualifications in the year ahead. Lower rental applicant risk can alleviate pain points for property managers and help avoid the risks of tenant default, and can also indicate a possible redistribution of applicants across Middle and Low Rent properties following rising rent prices across the country.

“It’s encouraging to see an increase in qualified rental applicants over the previous five years, which could indicate continued improvement of economic health,” said Dr. Ralph McLaughlin, deputy chief economist for CoreLogic. “Rents have since rebounded from the Great Recession and are now growing at the same pace as house prices. However, it’s important to note that these rising rents might be causing Middle Rent applicants to apply for Low Rent properties, which can indicate that a subset of the population now is becoming priced out of the traditional rental market.”

Rent-to-income levels decreased for renters of the least expensive rentals, indicating more available capital for those applicants. Incomes rose 4.7% for applicants of Low Rent properties (under $750 per month), while income of applicants of Middle Rent properties (between $750 to $1,100 per month) and High Rent properties (over $1,100 per month) remained flat from 2017 to 2018.

The RAR Report found rental applications were down for both Middle and Low Rent properties. While Middle Rent properties increased rent by 0.7% to an average of $899 in 2018, Low Rent properties remained flat at an average of $675. Applications for High Rent properties, which on average increased rent prices year-over-year by 0.26% to an average of $1,524, were up in 2018.

Regionally, the West is below average in rental applicant risk, while the Northeast, South and Midwest are above average compared to the U.S. index value of 83. The West had the lowest index value at 73, indicating a higher potential for positive lease performance in the region. The Northeast is the second least risky region, with a value of 85. The South and Midwest regions show higher index scores and thus illustrate lower credit quality among prospective renters.

Regional RAR Index, 2014-2018

|

REGION |

2014 |

2015 |

2016 |

2017 |

2018 |

|

Northeast |

86 |

87 |

87 |

85 |

85 |

|

West |

85 |

80 |

77 |

73 |

73 |

|

South |

94 |

91 |

89 |

87 |

86 |

|

Midwest |

95 |

93 |

90 |

89 |

89 |

|

Source: CoreLogic, 2019. |

|||||

The Index is calculated exclusively from applicant-traffic credit quality scores from the CoreLogic SafeRent® statistical lease scoring model, Registry ScorePLUS®. Registry ScorePLUS® is the multifamily industry’s only screening model that is both empirically derived and statistically validated.

For an interactive version of the 2019 RAR Report, which includes interactive charts and images, visit this link.

CoreLogic RAR Index Methodology

The CoreLogic® Renter Applicant Risk (RAR) Report is published annually by CoreLogic. The RAR Index is calculated exclusively from applicant-traffic credit quality scores from the CoreLogic SafeRent® statistical lease scoring model, Registry ScorePLUS®, and is based on an analysis of 31,000 properties representing apartment homes and single-family rentals.

The RAR Index provides a benchmark trend of national and regional traffic credit quality scores. The index value indicates the relative risk of an applicant pool fulfilling lease obligations. A risk index value of 100 indicates that market conditions are equal to the national mean for the Index’s base period of 2004. A risk index value greater than 100 indicates market conditions with increased average risk of default relative to the Index’s base period mean. A value less than 100 indicates market conditions with decreased average risk of default relative to the Index’s base period mean. Registry ScorePLUS is the multifamily industry’s only screening model that is both empirically derived and statistically validated. The statistical screening model is a supervised machine learning model and was developed from historical resident lease performance data to specifically evaluate the potential risk of a resident’s future lease performance. The model generates scores for each applicant indicating the relative risk of the applicant not fulfilling lease obligations.

To receive local or regional renter applicant risk data, please contact your CoreLogic Account Executive or Relationship Manager.

About CoreLogic

CoreLogic (NYSE: CLGX), the leading provider of property insights and solutions, promotes a healthy housing market and thriving communities. Through its enhanced property data solutions, services and technologies, CoreLogic enables real estate professionals, financial institutions, insurance carriers, government agencies and other housing market participants to help millions of people find, acquire and protect their homes. For more information, please visit https://www.corelogic.com/.

CORELOGIC, the CoreLogic logo, SafeRent and ScorePLUS are trademarks of CoreLogic, Inc. and/or its subsidiaries. All other trademarks are the property of their respective owners.

View source version on businesswire.com: https://www.businesswire.com/news/home/20190731005710/en/